Colorado Springs Vinyl Signs, Graphics, & Banners

VIEW GALLERYVinyl is a favored material to work within the signage industry, and with good reason. Vinyl has limitless applications and options, and is often used to enhance any workspace or brand any wall, floor, vehicle, or surface!

With a wide array of colors, types, weights, and finishes, we can select the best vinyl product to meet any business or personal need. Durable vinyl options can be used for cohesive vehicle wraps, including ATV’s, food trucks, and watercraft. It is ideal for high-traffic surfaces to allow you to promote your brand just about anywhere you could desire.

With so many vinyl options available, it can be difficult to know what product best fits your needs. Pinnacle Signs & Graphics provides a free consultation with our Colorado Springs signage experts to help you identify what products and applications will best suit your business, brand, and goals with a focus on maximizing visibility and brand recognition.

Call Pinnacle Signs & Graphics at (719) 428-6274 for your Free Consultation with a Vinyl Graphics Specialist!

Promotional Vinyl Banners

Banners are the most popular vinyl product we offer and come in a variety of different sizes, colors, weights, and display options. We print all of our banners on heavy-weight, durable vinyl that displays your marketing message professionally and attractively. Banners are ideal for controlling the flow of traffic and driving it to specific areas of your facility and are an attractive way to announce grand openings or support your staff at a tradeshow.

If you need a full display of signage for a tradeshow or on-site banners to announce new products or services, Pinnacle Signs & Graphics will craft the signage solutions you need to support your business and help you achieve the marketing goals you set.

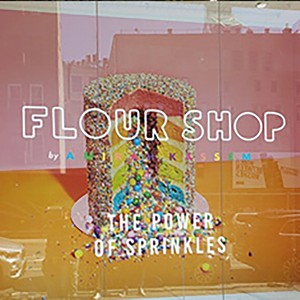

Window Vinyl Clings & Film

Promotional displays often include cut vinyl elements that can be either static-cling adhesion or are held in place with temporary sticky glue. These types of adhesion allow you to change your displays to reflect the changes in products or services and are ideal for fast moving or seasonal products. When stored correctly they can be used for multiple applications.

These vinyl options come in a variety of textures and styles to provide a highly-customized and attractive alternative to display your logo or message for that high-end professional look you desire.

Cut Vinyl Lettering

There is no better place to improve the professionalism of your business than your front door. Every customer expects to find certain information readily available before even entering your facility. Cut vinyl letters allow you to provide that much-needed information attractively and professionally and is ideal for displaying your hours of operation, business license or any other information you want.

Cut vinyl lettering and graphics allow you to add a level of professionalism to your business while providing the necessary information your customers and clients want and need as well as building your brand and business awareness.

When you want to make a great first impression, cut vinyl graphics and lettering will help you do just that!

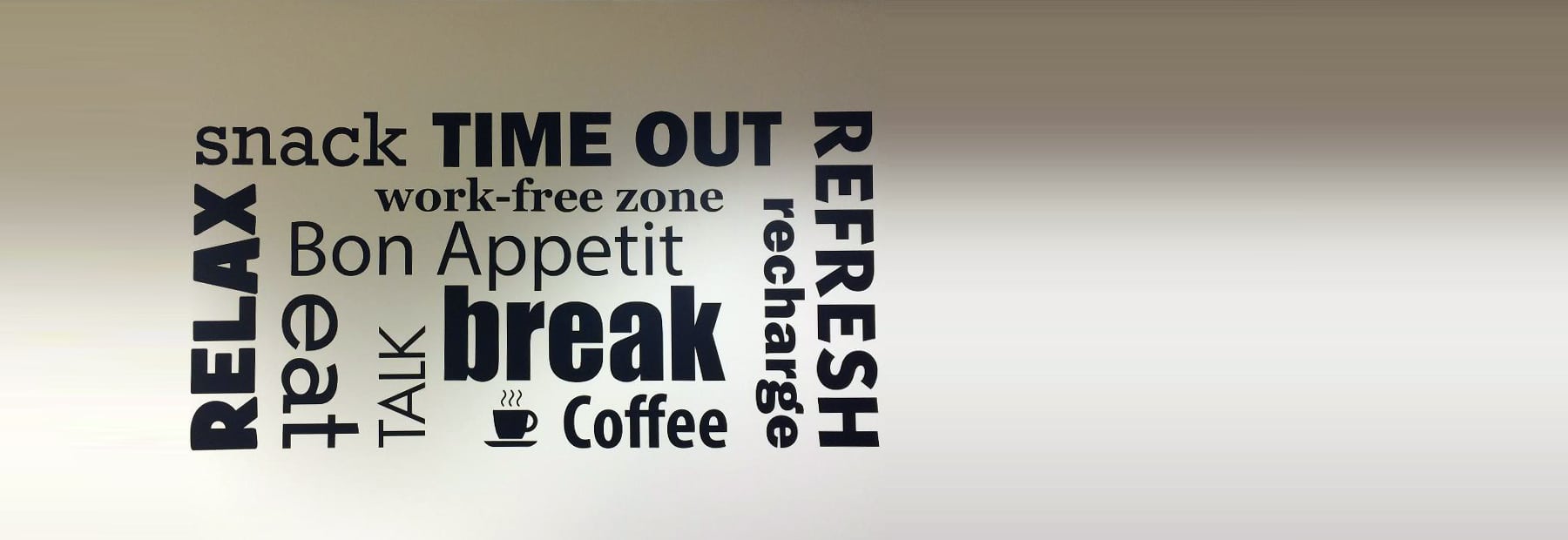

Wall Murals & Floor Graphics

Every business can benefit from solutions vinyl products offer. Vinyl value isn’t found only in its use on doors and windows but also on almost every surface you have. Large format graphics and murals can be applied to just about any smooth surface, allowing you to utilize surface area you never imagined to increase brand identification, wayfinding, or provide moral support!

With high-quality, durable wall murals, you can turn any dull space, hallways, or surface into an impactful, dynamic work of art. Pinnacle Signs & Graphics will assist with design, placement, production, and installation of your large format graphic to create an eye-catching environment for all to enjoy.

Your floors can be utilized to provide customer support, offer wayfinding assistance, or increase brand visibility. We craft attractive, durable floor graphics that can adhere to concrete, tile, wood, and even some carpets, allowing you to use nearly any surface for business and brand promotion!

Floor graphics are an impactful, attractive solution to support attendees at tradeshows or events by offering intuitive directional assistance.

Vinyl Graphics Options

At Pinnacle Signs & Graphics, we want the business signage you choose to be effective and reflect your business accurately, that’s why we offer a free consultation with our vinyl experts. We listen to your needs and goals and recommend the vinyl solution that best fits your brand and space, allowing you to maximize your marketing opportunities.

Popular uses for vinyl graphics include:

We believe that only custom signage can accurately reflect your business and support your marketing and branding goals. We don’t expect you to know what vinyl option or material you need, we will create the vinyl banners, murals, and graphics and any other outdoor signs and indoor signs you need to help you reach your marketing goals.

Full-Service Vinyl Graphic Shop

As a full-service signage provider, we provide complete design services to help you create the solutions you want even if you don’t know where to start. We will work with any existing brand guidelines, or create an entirely new brand guideline you can utilize moving forward. We will create a sample of your signage project that you can then edit, including logo placement, colors, fonts, and text as you desire. After your project is approved, our production team will begin fabricating and preparing your signage elements for installation.

Many of our signage products can be quickly and safely self-installed. For the more complex vinyl solutions, we offer complete installation services to ensure that your signage project is secured correctly and is free of bubbles, warps, tears, and is aligned correctly for your space.

Free Vinyl Signs & Graphics Consultation

Call Pinnacle Signs & Graphics at (719) 428-6274 for your Free Consultation with a Vinyl Graphics Specialist!